Distributed Solar Policy and Rate Design During 2016

The intention of this report is to illustrate how states are choosing policies associated with distributed solar photovoltaics (PV). With an emphasis on the residential sector, this report catalogs proposed and enacted legislative, regulatory, and rate design changes affecting the value proposition of distributed solar PV.

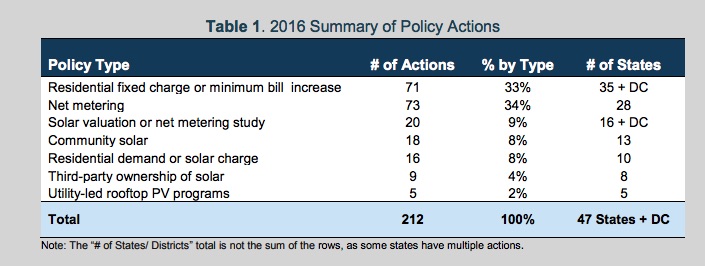

The 50 States of Solar fourth-quarter report in 2016 shows that 47 states and the District of Columbia have taken some type of policy action. The summary of policy actions in 2016 are shown in the table below:

TOP 10 MOST ACTIVE STATES HIGHLIGHTS IN 2016

- Arizona is one of the top states to have contributed to policy changes in 2016. The states’ proceedings on the value of distributed generation (DG) set the foundation for the net metering successor tariff. With all three of the state’s investors-owned utilities requesting major changes to the following:

- Net metering

- Residential demand charges

- Increased residential fixed charges

- Nevada spent 2016 debating net metering changes implemented in 2015. A settlement directed an initiative to grandfather customer-generators that were not formerly included. Regulators also restored retail rate net metering for Sierra Pacific Power customers (now being contested).

- Main’s net metering remained unclear at the years’ end. The solar stakeholder group submitted a report contributing to the successor’s policy, which was vetoed by legislation. In response, the Public Utility Commission initiated a formal rulemaking to revise the states’ net metering policy.

- New York continued Reforming the Energy Vision (REV) proceeding. As REV advanced, the Public Service Commission started Phase II of Value of Distributed Energy Resources (DER). Through DER “LMP + D” emerged as a new valuation methodology. This attracted notable attention across the nation.

- California became an early adopter utilizing a net metering successor tariff. The state also developed practices regarding net metering of solar plus storage systems. They also saw Imperial Irrigation District adopt net metering successor tariff.

- Massachusetts compromised on legislation. Eventually passing a bill that increased the state’s aggregate cap on net metering. The legislation also facilitated the additional changes:

- Reduce net excess generation credit rate for specific demographics.

- Sanctioned Department of Public Utilities to establish a minimum bill for net metering customers

- Directed Department of Energy Resources to improve a solar incentive plan to supersede the SREC ll program.

- Florida experienced a controversial ballot initiative in 2016. The ballot proposed to amend the state constitution to ensure solar customers are not subsidized by non-solar customers. This initiative was a counterproposal to a separate ballot, defeated in November of 2016. Florida also had two major investor-owned utilities propose a residential fixed charge increase.

- Hawaii ended net metering in 2015. This left customers with two options; Grid Supply and Self Supply. Grid Supply hit its’ cap in 2016 with Self Supply as the only option. A community-based renewable program was drafted by the Hawaii Public Utilities Commission to credit customers at time-varying rates.

- New Hampshire supported legislation passage of H.B. 1116. Following legislation, the Public Utilities Commission initiated the development of the successor. Two of the state’s utilities proposed raised fixed charges, and one motioned for a demand charge for residential solar customers.

- Colorado’s Xcel Energy’s Grid Use Charge was dropped in a settlement agreement in favor of time-of-use rates. The original proposal would have incorporated a tiered grid use charge on top of monthly fixed charges. Xcel conceded to move all residential customers to the time of use pilot.

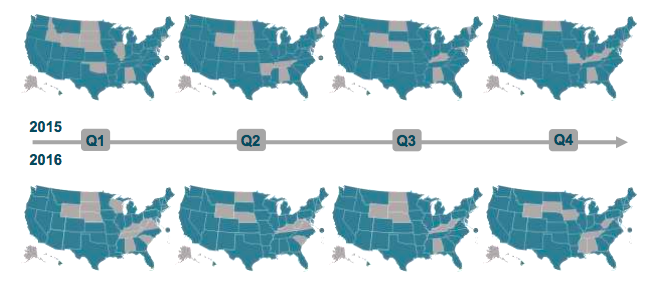

SOLAR POLICY ACTION BY QUARTER (Q1 2015 –Q4 2016)

“Overall, we saw an increase in solar policy action from 2015 to 2016,” said Autumn Proudlove, lead author of the report and Senior Policy Analyst at NCCETC. “Notably, states considered more specific changes to net metering policies in 2016 and undertook fewer studies related to net metering. Many of these states have already conducted studies by now and are ready to take action.”

IN COMPARISON: 2016 VS. 2015

A total of 131 actions were tracked in Q4 amongst 42 states and D.C., making it the busiest quarter of the year. NCCETC foresees this high level of state and utility development on solar policy and rate design to extend into 2017.

Brian Lips, Energy Policy Project Coordinator at NCCTC commented, “2016 was a very busy year for policymakers and those of us tasked with staying on top of their activity.” Lips continued to note, ” With several state solar markets hanging in the balance, 2017 is looking like it will be another exciting year.”